While the leading virtual asset, Bitcoin, continues to heat up the global market, the stock market is fraught with unease due to the absence of leading stocks and the mass exodus of individual investors.

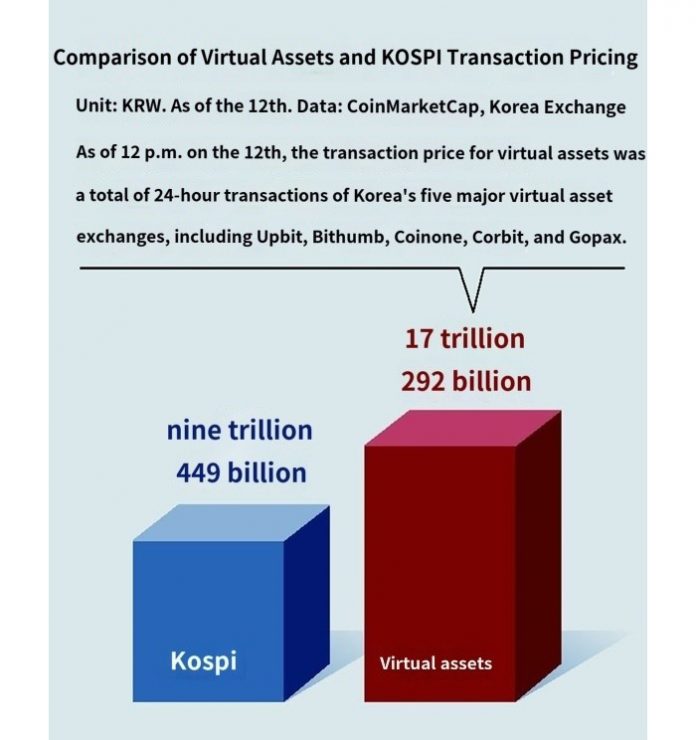

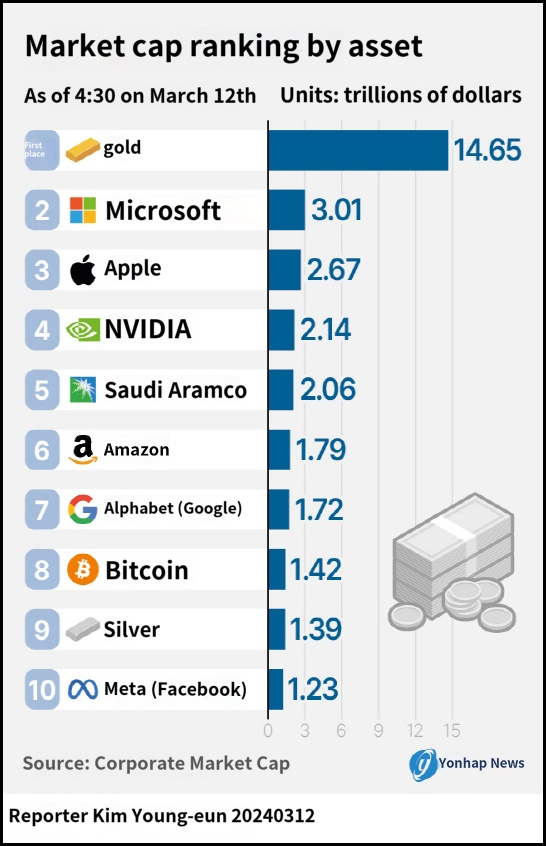

Bitcoin’s record-breaking surge is fueling the fear of missing out (FOMO) mentality, igniting concerns that “if you miss out, you’ll regret it.” Recently, Bitcoin’s market capitalization has surpassed that of the global silver market, and the trading volume of domestic virtual assets is nearly double that of the KOSPI. Consequently, individual investors are showing a preference for the virtual asset market over the stock market.

The domestic stock market is in a state of unease due to the absence of leading stocks, leading to a significant exodus of individual investors. While foreign investors are entering the stock market with expectations for corporate valuation programs, individuals are leaving the stock market in search of higher returns.

The popularity of the virtual asset market is linked to the unease in the stock market. With the domestic stock market undergoing policy changes without context, losing market confidence, individuals are showing more interest in Bitcoin, a single asset. Particularly, Bitcoin’s characteristic of rising in tandem with overseas prices makes it an attractive option for individual investors.

Experts warn of a possible decline due to Bitcoin’s halving scheduled for April, emphasizing the need for careful consideration when dealing with volatile virtual assets.

Despite the circumstances, the virtual asset market continues to thrive, with concerns in the stock market triggering significant capital inflows into the virtual asset market. Nevertheless, experts advise investors to approach with caution and diversify their assets.

![[November]Uptober No More](https://coinhubkorea.com/wp-content/uploads/2025/10/Whisk_d78880efb01a730907f4be201effefe1dr-1-100x70.jpeg)