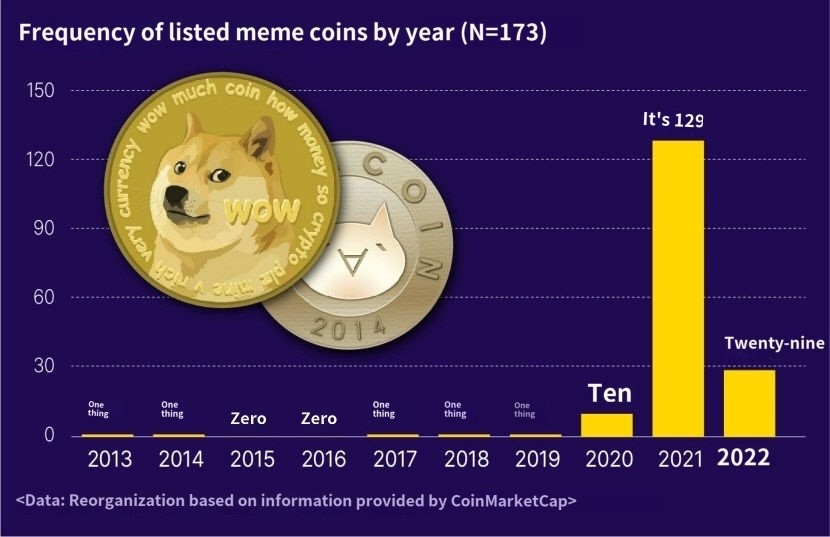

Recently, the discussion on the positive potential of meme coins in the cryptocurrency market has been vibrant, with Arthur Hayes, co-founder of BitMEX, positively evaluating the impact of these coins on the blockchain ecosystem. He highlighted that meme coins could attract new users and developers, contributing to the advancement of blockchain technology, with blockchain networks like Solana and Ethereum potentially benefiting the most from this phenomenon.

However, Kimchi coins, issued and traded within South Korea, show a somewhat lackluster performance in contrast to the successful surge of meme coins. Despite the rapid rise of Bitcoin (BTC) and major altcoins, this phenomenon is particularly pronounced domestically. Kimchi coins like WEMIX, Orbit Chain (ORC), and Somesing (SSX) have experienced value declines due to hacking issues, controversies over circulation and issuance, etc.

This situation reveals that despite active trading of meme coins and altcoins in Korea, Kimchi coins have not gained sufficient trust from the market and investors. The trust in K-coins significantly declined after the Luna-Terra incident, and the ongoing issues have cooled investor interest, with exchanges becoming cautious about listings.

In contrast, meme coins often experience rapid surges in the global market, suggesting that projects related to meme coins in Korea have high potential for success. As Arthur Hayes suggested, meme coins have the potential to positively impact the blockchain ecosystem. Considering the high interest in these coins within Korea, if security issues and reliability are addressed and properly executed meme coin projects based on creative and innovative ideas emerge, the likelihood of success is very high. This could be an opportunity for Korea to play a significant role in the global cryptocurrency market and exert leadership.