Arthur Hayes, co-founder of Maelstrom and former co-founder of BitMEX, made another bold prediction on stage at Blockfesta 2025, held at the Textile Center in Samseong-dong, Gangnam, Seoul. He stated, “If the Trump administration pushes ahead with rate cuts and liquidity expansion policies, it will drive global credit higher and provide powerful upward momentum across the digital asset market.”

Hayes highlighted the Federal Reserve Board’s composition as a key factor for the crypto market. “President Trump has already placed four loyalists on the Fed’s seven-seat Board, and if Governor Lisa Cook resigns, a majority could be secured,” he explained. With such control, rate cuts and deregulation of banks could expand low-cost lending, which in turn could boost U.S. industrial output.

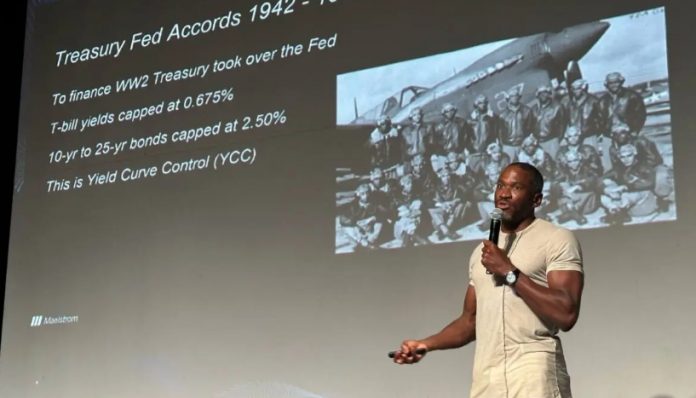

He further argued that if Trump also secures a majority within the Federal Open Market Committee (FOMC), a return to “yield curve control (YCC)”—last seen in 1951 when the Treasury and Fed directly set long-term bond yields—would be possible. “If the Fed Board sets the interest on reserve balances (IORB) below the policy rate, banks would attempt risk-free arbitrage through the discount window, forcing the FOMC to lower rates in response,” Hayes said. “Ultimately, the FOMC could use the System Open Market Account (SOMA) to buy Treasuries and fix yields at target levels, executing YCC under the banner of ‘QE 4 Poor People’ to support America’s reindustrialization.”

According to Hayes, such monetary expansion and accelerated credit growth would place sustained upward pressure on Bitcoin. He predicted, “By 2028, the digital asset market will grow at an extraordinary pace, and in the long run, Bitcoin could surpass $3.4 million.”

Hayes also touched on the Korean market. “If won-based stablecoins are issued and offshore account access is permitted, foreign investors will find it easier to participate,” he noted. “Relaxing derivatives leverage to match overseas levels would also draw more capital into Korean exchanges.”

His remarks at Blockfesta underscore how shifts in U.S. politics and monetary policy, alongside Korea’s regulatory framework, could shape the next wave of digital asset growth.