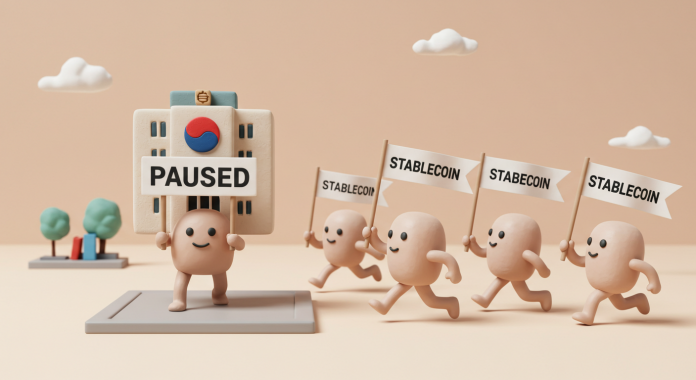

The Bank of Korea has decided to suspend its central bank digital currency (CBDC) development plan, prompting domestic financial institutions to accelerate their push into stablecoins. For the past three years, the central bank has been assessing the technical, legal, and financial stability aspects of a CBDC but announced that “several issues remain unresolved based on pilot program results.”

A Bank of Korea official explained, “CBDCs can help innovate payment systems, but risks such as commercial bank deposit outflows and market disruption are still significant.” Nevertheless, the central bank plans to maintain its research infrastructure and review the possibility of resuming the project depending on future developments.

In response, banks and credit card companies are moving quickly to develop stablecoins pegged to the Korean won. Major financial institutions including KakaoBank, Hana Bank, and Woori Bank are preparing a consortium to issue won-denominated stablecoins, while some have formed internal task forces to build dedicated platforms. One banking executive commented, “The suspension of CBDC could actually become an opportunity for private-sector stablecoin ecosystems to expand.”

The Financial Services Commission stated that it will “allow private-led innovation in stablecoins but will carefully consider full-scale regulatory frameworks.” Experts have voiced concern that “CBDC is a key strategic asset in the global race for digital currencies, and Korea may lose its lead.”

Others argue that rigorous safeguards—such as real-time audits and full-reserve requirements—are also essential for stablecoins to prevent money laundering and protect consumers. However, some banks contend that “stablecoins with more flexible regulations can bring payment innovation faster than a CBDC.”

The Bank of Korea emphasized that “we will comprehensively assess international developments and market demand before deciding when to restart the project” and confirmed that CBDC research will continue. In the second half of the year, pilot programs and guidelines for stablecoin issuance are expected to move forward in earnest.