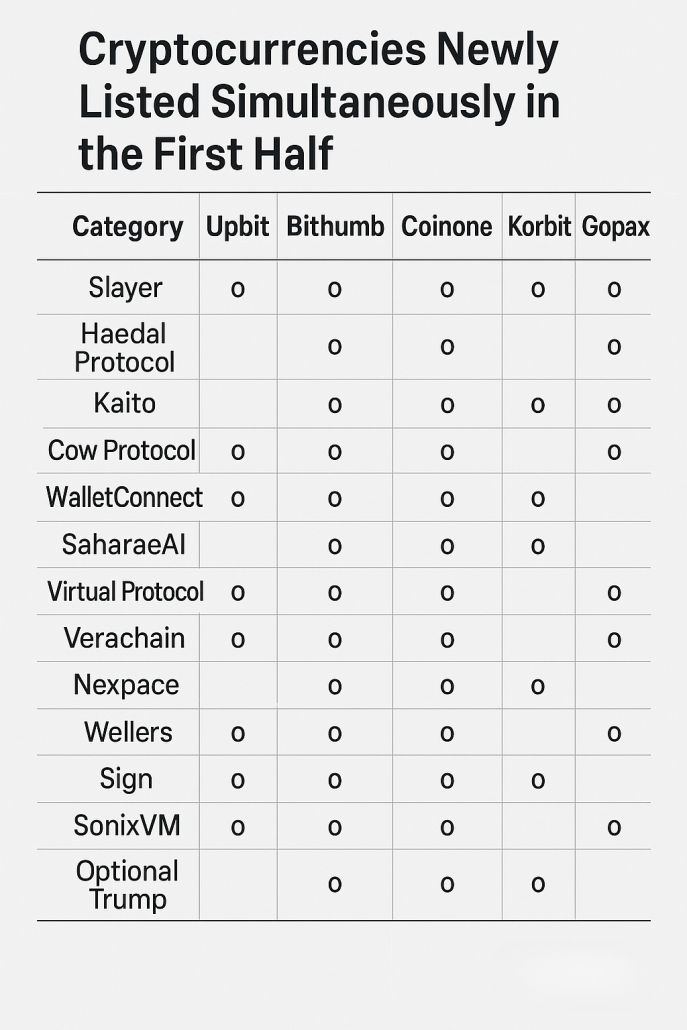

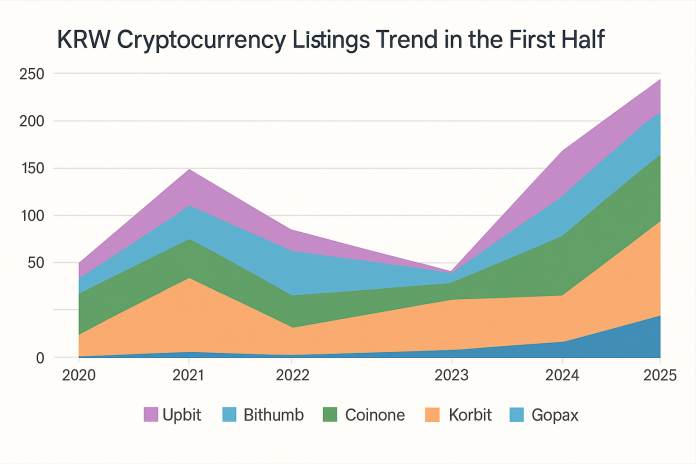

In the first half of this year, the number of new cryptocurrencies listed on domestic exchanges increased by 33% compared to the same period last year, signaling renewed market activity. According to industry data, Upbit, Bithumb, Coinone, and Gopax listed a total of 98 new tokens, up from 74 in the first half of 2024.

A notable trend among these new listings is the dominance of specialized projects focused on AI, real-world asset (RWA) linkage, and Layer 2 solutions. An industry official explained, “The global boom in AI and growing demand for tokenized real-world assets are driving a shift away from purely utility tokens.” Some exchanges have also combined staking services with new listings to boost trading volume and strengthen their competitive edge.

Behind this surge is the intensifying competition among exchanges for market share and fee revenue. According to CoinMarketCap, the total transaction volume for newly listed tokens on Korea’s four major exchanges reached about 9 trillion won in the first half, while average daily trading volumes for these new coins rose more than 40% year-on-year. However, some observers warn that loosening listing criteria could undermine investor protection. One expert noted, “If project sustainability and token distribution are poorly managed, extreme price swings after listing can harm investors.”

In fact, newly listed tokens this year recorded an average three-month volatility of ±42%. Financial authorities plan to revise listing guidelines in the second half to reduce volatility and improve trust. Regulatory reforms linked to the Virtual Asset Business Act are also under review to strengthen due diligence procedures.

Exchanges are expanding review teams and tightening disclosure requirements as part of voluntary self-regulation measures. A spokesperson for a major exchange said, “Active listings are a sign of market growth, but robust verification systems are essential to maintain credibility.”

New AI and RWA-focused listings are expected to continue in the second half of the year, and investors will need to carefully scrutinize each project’s business model and distribution plans.