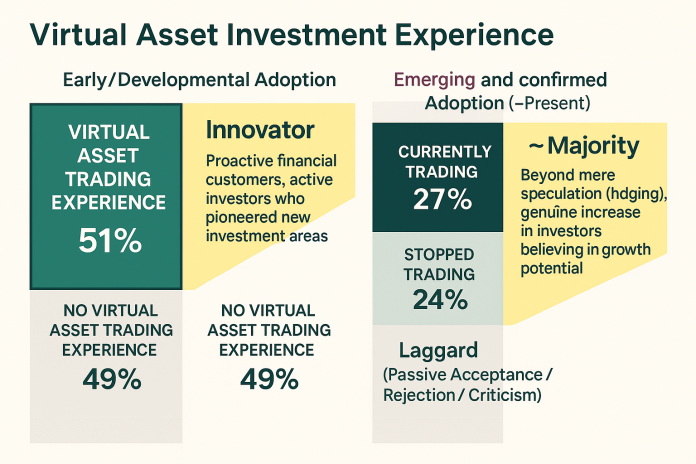

Nearly half of Korean investors aged 20 to 50 have experience investing in crypto assets, according to a new report released by Hana Financial Group’s research institute. The study, titled Crypto Asset Investment Trends Among the 2050 Generation, found that 47% of respondents in this demographic had invested in cryptocurrencies, and 27% currently still hold them, highlighting that crypto investment is no longer confined to niche groups.

On average, crypto investors reported financial assets totaling approximately KRW 97 million—over 30% higher than the KRW 75 million reported by those who had never invested in crypto. Among these investors, about 14% of total assets, or roughly KRW 13 million, were held in crypto.

The demographic profile revealed a heavy skew toward men: 67% of crypto investors were male, and most were in their 30s and 40s working in white-collar occupations. However, the report also noted a gradual increase in participation among younger adults in their 20s and among women, who often start with small investments and expand holdings over time.

Investment behavior has also evolved. In the early stages, buying was often driven by FOMO (fear of missing out) and short-term speculation. Over time, a more analytical and planned approach has gained ground. The proportion of investors citing FOMO as their main motivation fell from 57% to 34%, while those who now view crypto as part of a long-term asset portfolio are steadily rising. While Bitcoin remains the most commonly held asset, ownership is gradually diversifying to include altcoins and stablecoins. Likewise, buying patterns have shifted toward regular purchases and longer holding periods.

The report highlighted major friction points in the investor experience, particularly the regulatory requirement that each exchange be linked to a designated bank account. 76% of respondents reported inconvenience or technical failures when trying to link accounts, and many said this “one exchange–one bank” rule was a primary obstacle to continued investing. Analysts warned that these systemic hurdles could become a critical factor affecting future participation.

Hana Financial’s researchers concluded, “Crypto assets have already become a key part of financial portfolios among Koreans in their 20s through 50s. As small-scale and long-term investment behaviors grow, closer integration with traditional finance and clearer legal frameworks will be essential.”