Starting June 24, all cryptocurrency exchanges in South Korea that support KRW (Korean won) trading are required to implement a unified “Withdrawal Delay System.” This nationwide policy follows a coordinated effort between the Digital Asset Exchange Alliance (DAXA) and financial authorities, aiming to block voice phishing scams and illicit fund transfers.

The new system mandates that when users deposit KRW to purchase crypto assets, they will face a mandatory holding period before being allowed to withdraw the purchased assets. The delay periods are as follows:

-

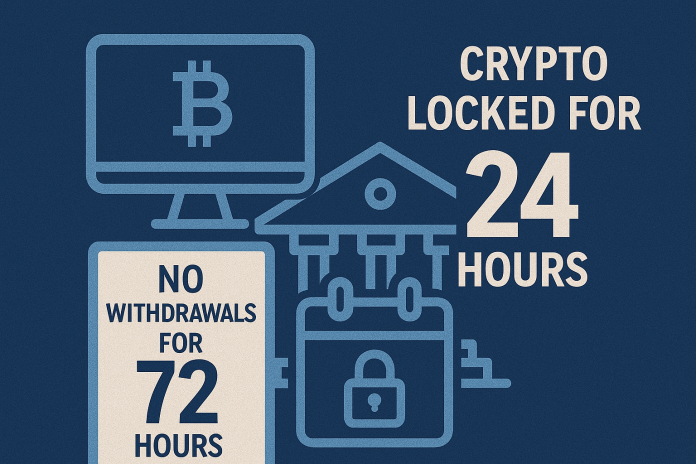

For first-time KRW deposits, users cannot withdraw any crypto assets for 72 hours (3 days).

-

For subsequent deposits, crypto equivalent to the deposit amount is locked for 24 hours.

This mechanism is designed to prevent immediate withdrawal and off-platform transfers, which have been widely exploited in phishing schemes and illegal remittance operations. While some exchanges had previously introduced similar policies voluntarily, this marks the first time the system is being implemented uniformly across the industry.

Authorities and industry leaders describe the move as a landmark example of self-regulation. The Financial Services Commission and DAXA emphasized that the system aims to strengthen user protection and reinforce trust in the digital asset ecosystem. The announcement comes in the wake of increasing public concern over the exploitation of crypto platforms for criminal purposes.

In recent months, several high-profile phishing incidents highlighted how scammers launder stolen funds through Korean exchanges. With this delay system, law enforcement will have more time to intercept and investigate suspicious transactions before funds vanish across blockchain networks.

Despite potential inconveniences, crypto platforms believe users will ultimately benefit. A representative from one major exchange noted, “While the delay may seem inconvenient at first, it’s a necessary safeguard. In the long run, investors will understand that this protects their assets.”

The system is also expected to serve as a blueprint for regulatory frameworks, signaling a shift toward greater accountability and proactive risk management within South Korea’s digital finance sector.

![[August] How to Find a Reliable Crypto Influencer: A Guide](https://coinhubkorea.com/wp-content/uploads/2025/08/ChatGPT-Image-2025년-8월-7일-오후-02_24_28-324x235.png)