Tensions are rising between the Bank of Korea (BOK) and commercial banks over control of the future digital payments infrastructure, as stablecoins gain traction as an alternative settlement method. While banks are moving quickly to adopt stablecoins for cross-border transactions, the BOK is reinforcing its stance on maintaining monetary authority through central bank digital currency (CBDC).

In its recently released 2024 Payment and Settlement Report, the BOK warned that widespread use of stablecoins as a substitute for legal tender could undermine monetary policy, financial stability, and the central bank’s role in payment systems. The report also raised concerns over the volatility of foreign-denominated stablecoins, particularly if capital inflows and outflows become harder to control.

Meanwhile, major banks like Shinhan, NH Nonghyup, and K Bank are participating in “Project PAX,” a cross-border remittance pilot with Japanese financial institutions. The initiative involves sending Korean won-based stablecoins and receiving yen-based ones, aiming to demonstrate faster and cheaper payments without relying on the SWIFT network.

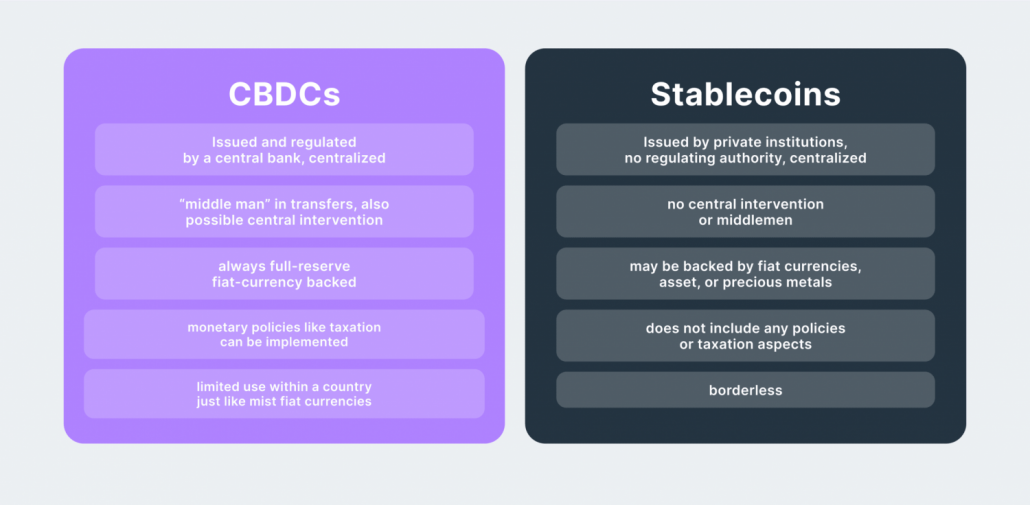

Regulators are reviewing global legislative trends—including those from the U.S., Japan, and the EU—with some openness to the coexistence of CBDCs and private stablecoins. Still, the BOK reiterated that “CBDCs are more transparent and reliable,” and emphasized that physical cash will remain essential, particularly for people without access to digital tools.

As stablecoin use expands and regulatory frameworks evolve, South Korea’s monetary authorities and financial institutions appear to be entering a delicate tug-of-war over who will shape the next generation of digital currency systems.