The Financial Services Commission (FSC) and the Financial Supervisory Service (FSS) have referred suspects involved in systematic price manipulation within South Korea’s virtual asset market to prosecutors. This marks a significant step in cracking down on unfair trading practices in the crypto industry.

The suspects exploited structural characteristics of the market—such as 24-hour trading and multi-exchange listings—to trigger short-term price surges and deceive investors. Authorities have identified two primary manipulation tactics.

■ “Racehorse” Method

This method involves accumulating large volumes of a specific coin just before the daily price reset time, typically at 9:00 AM. The manipulators then submit rapid buy orders—1 to 2 per second—for 20 to 30 minutes, creating the illusion of strong upward momentum. This often triggers “chasing trades” by unsuspecting investors.

■ “Cage Pumping” Strategy

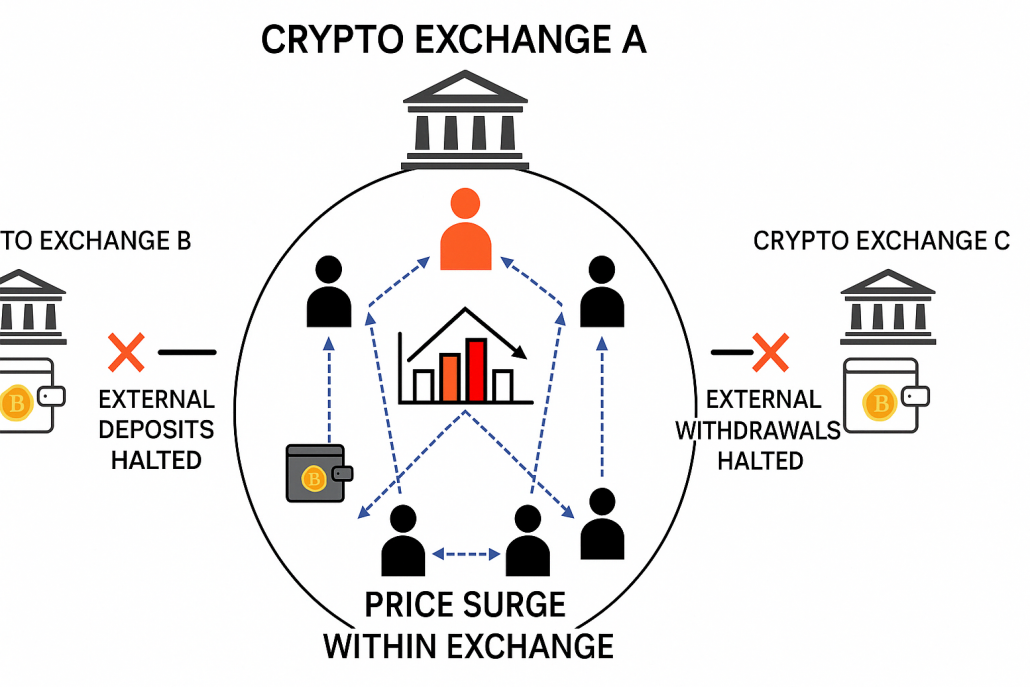

This tactic takes advantage of coins that are temporarily designated as “cautionary assets,” which suspends their deposits or withdrawals. The manipulators pre-buy low-circulation coins during these windows and artificially boost prices and trading volumes within the isolated exchange, where external arbitrage is impossible.

These practices led to extreme volatility, with prices skyrocketing up to 10 times higher than on other exchanges—only to crash back to pre-manipulation levels once the pumping stopped.

■ Warnings and Penalties

Authorities warn investors to avoid chasing sudden price surges—especially those without fundamental reasons or occurring during deposit/withdrawal suspensions. Checking whether a coin is marked as “under caution” is also strongly advised.

These acts fall under violations of the Virtual Asset User Protection Act, which imposes punishments of at least one year of imprisonment, fines up to five times the profit made, and administrative penalties of up to double the illegal gains.

The FSC and FSS emphasized they are strengthening monitoring systems to detect abnormal trading activity from the order placement stage and will continue rigorous enforcement to maintain market integrity.