Financial authorities are moving to formally discuss allowing corporate investments in virtual assets, signaling potential significant changes for the domestic virtual asset market. Industry experts anticipate that corporate investment will boost liquidity and improve the credibility and transparency of the highly volatile domestic virtual asset sector.

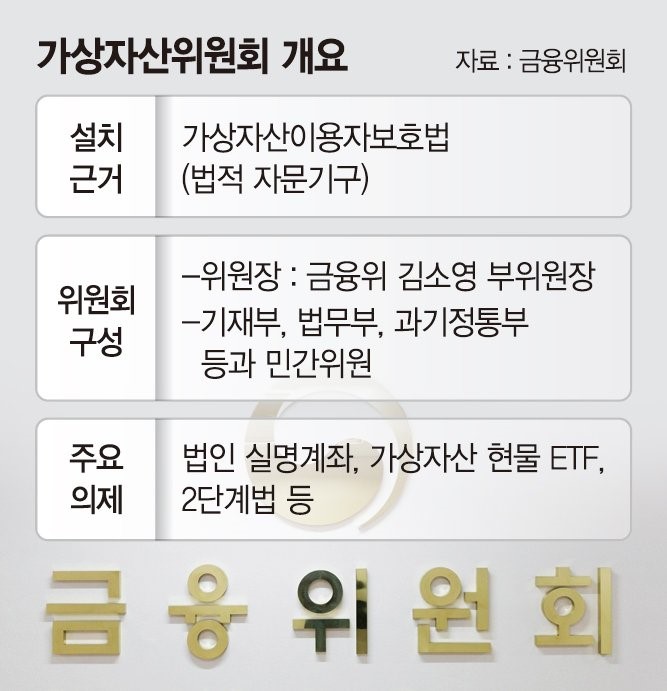

Recently, the Financial Services Commission (FSC) announced during a National Assembly audit that it plans to form a Virtual Asset Committee to discuss the issuance of virtual asset accounts for corporations and the potential launch of physical Bitcoin Exchange Traded Funds (ETFs). FSC Chairman Kim Byeong-hwan mentioned that the committee is expected to launch this month, accelerating discussions on activating corporate investments.

While there is no explicit legal prohibition on corporate investment in virtual assets in Korea, financial authorities have been regulating corporate investments by preventing banks from issuing real-name accounts for virtual asset investments. However, if real-name accounts are allowed for corporations, it is anticipated that large institutional funds, including pension funds, could flow into the market. This would significantly increase the market’s scale and potentially create jobs in areas like brokerage, asset management, and custody services.

Industry reports suggest that allowing corporate investment could generate up to 46 trillion KRW ($34 billion) in economic value by 2030, along with 150,000 new jobs. Major countries like the U.S. and Japan are already seeing active corporate investments in virtual assets. In the U.S., universities like Harvard and Yale have been profiting from Bitcoin investments, and some state governments have begun investing pension funds in virtual asset funds. Japan is also considering including Bitcoin in its Government Pension Investment Fund (GPIF).

In Korea, if corporate investment is allowed, the National Pension Service (NPS) could also directly invest in assets like Bitcoin. Currently, NPS holds shares in Coinbase as a form of indirect investment, but the potential allowance of corporate accounts would pave the way for direct investments and higher returns.

However, concerns over money laundering risks remain significant. There is internal opposition within financial authorities, citing the high volatility of virtual asset prices and the risks of illicit activities. Some experts also point out that without sufficient legal frameworks and guidelines, allowing corporate investments too soon could result in unforeseen issues. This means that the process of permitting corporate investments might take more time.

The virtual asset industry views the allowance of real-name corporate accounts as a crucial step toward enhancing market liquidity and transparency in Korea. The FSC is expected to carefully review various issues related to corporate virtual asset investment before making a final decision on whether to issue real-name accounts for corporations.