In the future, if a virtual asset service provider (VASP) goes bankrupt, banks will be required to return deposits to users. The Financial Services Commission (FSC) announced on the 25th that the draft enforcement decree of the ‘Virtual Asset User Protection Act’, which regulates the details of the law to be implemented from July 19th, has been approved at the Cabinet meeting.

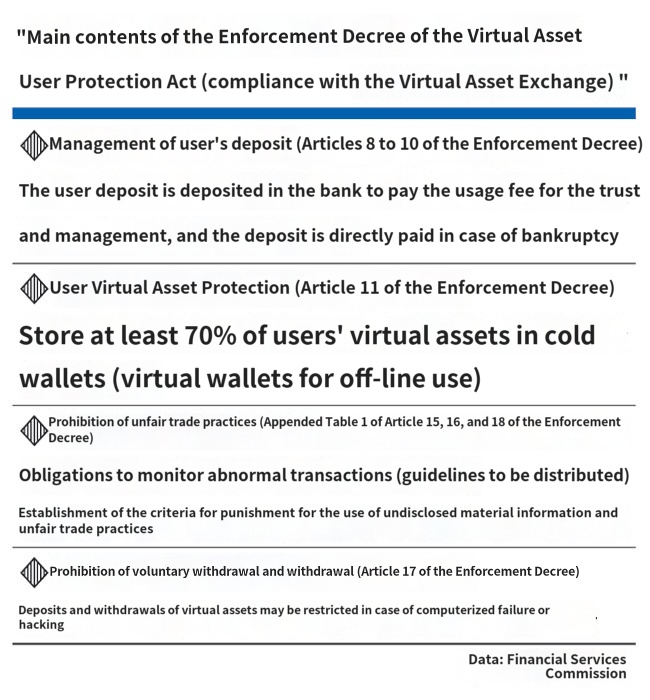

The law defines virtual assets, as in the current Act on Reporting and Using Specified Financial Transaction Information, as ‘electronic certificates that can be traded or transferred electronically with economic value’. The enforcement decree added electronic bonds, mobile gift certificates, deposit tokens, and non-fungible tokens (NFTs) to the list of items excluded from the definition of virtual assets. User deposits must be stored in reputable banks and managed in safe assets.

In the event of bankruptcy or the cancellation of a business registration of a virtual asset service provider, the bank must announce the payment time and place in daily newspapers and on their website, and directly pay the deposits to users. Additionally, virtual asset service providers must store more than 70% of user virtual assets in cold wallets, which are wallets separated from the internet, at a rate determined by the FSC (80%).

The Virtual Asset User Protection Act requires virtual asset exchanges to constantly monitor unusual transactions and delegates the definition of such transactions to the enforcement decree. The decree defines unusual transactions as cases where the price or trading volume of virtual assets fluctuates abnormally, or when there are rumors or reports that could affect the price of virtual assets.

The law allows for life imprisonment for unfair trading activities, and the enforcement decree specifies how to calculate the amount of unfair profit. The decree categorizes the calculation of unfair profit into realized profit, unrealized profit, and avoided loss, and provides detailed regulations for each type of unfair trading activity (use of undisclosed important information, market manipulation, and fraudulent transactions).

The decree also stipulates the legitimate reasons for which a virtual asset service provider can block the deposits and withdrawals of user deposits and virtual assets, such as information network system failures, maintenance, and hacking incidents. If the deposits and virtual assets are related to illegal assets, such as proceeds from serious criminal activities under the Act on Regulation and Punishment of Criminal Proceeds Concealment, withdrawals and deposits can be blocked for up to six months if this is stated in the terms and conditions.

Additionally, the FSC will establish a Virtual Asset Committee chaired by the FSC Vice Chairman to provide advice on virtual asset policies and systems.

![[November]Uptober No More](https://coinhubkorea.com/wp-content/uploads/2025/10/Whisk_d78880efb01a730907f4be201effefe1dr-1-100x70.jpeg)