With the Cryptocurrency User Protection Act set to take effect next month, cryptocurrency exchanges will conduct a comprehensive review of the listing status of approximately 600 cryptocurrencies currently in trade. Subsequent reviews will be conducted quarterly, and those failing to meet standards will be designated as cautionary assets before being delisted.

According to the cryptocurrency industry, financial authorities are preparing a model guideline for cryptocurrency trade support, which will be implemented across all exchanges on July 19, concurrent with the enactment of the Cryptocurrency User Protection Act. As a result, the 29 cryptocurrency exchanges registered with financial authorities, including Upbit, Bithumb, Coinone, Korbit, and Gopax, will have to conduct their first review to determine whether to maintain the listing (trade support) of all cryptocurrencies they currently trade.

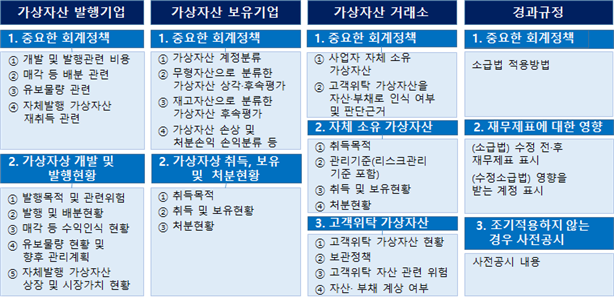

The review criteria set by the mandatory trade support review and decision-making bodies at each exchange include the issuer’s credibility, user protection measures, technology, security, and legal compliance. Additionally, the review will cover the issuer’s operational and development capabilities, social credit, past business history, disclosure of important cryptocurrency-related information, the ability for holders to participate in decision-making, transparency in cryptocurrency operation, total issuance and circulation volume, market capitalization and appropriate distribution, potential conflicts of interest between holders and exchanges, measures to resolve conflicts of interest between exchanges and users, security of distributed ledgers and cryptocurrencies, and the presence of concentration risks in distributed ledgers.

A financial authority official stated, “For existing cryptocurrencies being traded, exchanges will be supported to review the trade support status over a six-month period,” adding, “Thereafter, a review will be conducted every three months.” Cryptocurrencies that fail to meet the trade support criteria will inevitably face trade support suspension.

However, to prevent issues where cryptocurrencies like Bitcoin or coins issued by decentralized autonomous organizations (DAO), which do not have a specific issuer, fail to meet the review criteria and thus become difficult to trade in the domestic market, alternative review measures will be introduced. For cryptocurrencies that have been normally traded for more than two years in overseas markets with adequate regulatory frameworks such as the US, UK, France, Germany, Japan, Hong Kong, Singapore, India, and Australia, some review requirements will be relaxed.