Amid the soaring prices of cryptocurrencies, including Bitcoin, changes have been observed in the attitudes of banks towards partnerships with cryptocurrency exchanges for real-name accounts. Bitcoin’s price has surpassed 100 million won for the first time, drawing more attention due to investors’ high expectations and the upcoming halving, which will cut the supply of cryptocurrencies in half.

Traditionally, banks have been cautious about partnering with cryptocurrency exchanges for real-name accounts. However, with the recent rise in Bitcoin prices, they are becoming more proactive in attracting customers from cryptocurrency exchanges. A major motive behind this shift is the potential for increased fee income from these exchanges. For instance, K Bank reported a fee income of 29.2 billion won during the cryptocurrency market boom in 2021, exceeding its net profit.

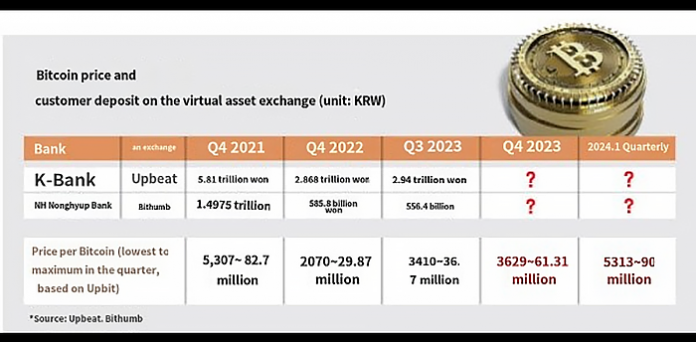

Currently, five banks—K Bank (Upbit), Kakao Bank (Coinone), Shinhan Bank (Korbit), NH Nonghyup Bank (Bithumb), and Jeonbuk Bank (Gopax)—have partnerships with cryptocurrency exchanges. As cryptocurrency trading becomes more active, these banks can earn more in fee income. Cryptocurrency exchanges are required to obtain real-name accounts from banks under the Specific Financial Transaction Information Act, and for every deposit or withdrawal in Korean won, exchanges pay the banks a fee ranging from 300 to 1000 won.

KB Kookmin Bank recently proceeded with a contract to issue real-name accounts with Bithumb, the second-largest domestic cryptocurrency exchange, but ultimately withdrew its intention to contract. This decision was influenced by negative perceptions of cryptocurrencies, money laundering concerns, and other issues. Despite the contract not materializing, the fact that such negotiations took place is considered significant progress in the industry, and this trend is expected to continue.

Considering the banking sector’s common goal of expanding non-interest income, interest in cryptocurrencies is expected to grow further. The buoyancy of the cryptocurrency market and the clarification of related regulations are likely to be key drivers for banks to actively pursue partnerships with cryptocurrency exchanges.