Korea Digital Asset (KODA) announced that it has surpassed a total custody value of 8 trillion KRW. KODA was jointly established in November 2020 by KB Kookmin Bank, blockchain investment firm Hashed, and blockchain technology company Haechi Labs as a specialist in digital asset custody. Custody services involve a third party safely storing and managing digital assets on behalf of clients, functioning similarly to a bank. Internationally, major banks like Goldman Sachs and Citibank are directly offering custody services.

KODA began offering its custody services to corporations and institutions in 2021 and has seen its custody amount exceed 8 trillion KRW in just about three years, marking a rapid growth. This figure is more than three times the amount reported by the Financial Intelligence Unit (FIU) of the Financial Services Commission in June of the previous year, which stood at 2.3 trillion KRW. Anticipating an increase in the demand for custody services due to the gradual institutionalization of digital assets, KODA has been enhancing its system to the level of financial institutions over the past year.

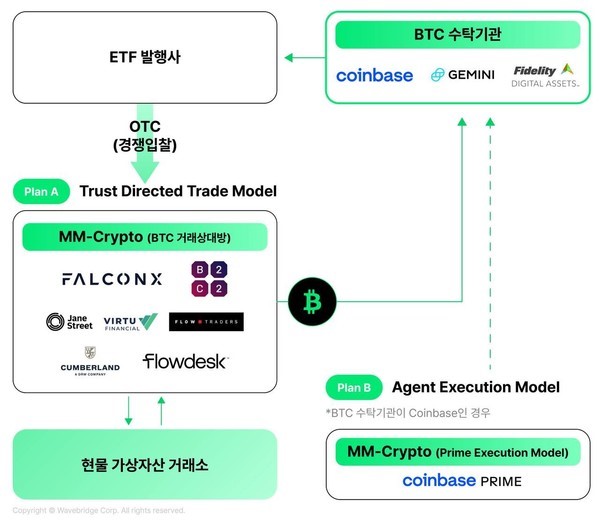

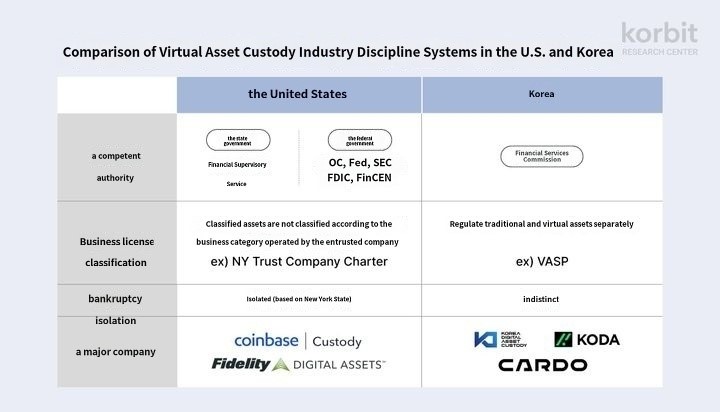

At the end of last year, KODA appointed Jo Jin-seok, who was overseeing the technology innovation center at KB Kookmin Bank, as its new CEO. Currently, 60% of KODA’s employees have a background in banking. CEO Jo Jin-seok emphasized that KODA would play a crucial infrastructure role if a Bitcoin spot ETF (Exchange Traded Fund) were approved in South Korea. Furthermore, Hashed CEO Kim Seo-jun highlighted the importance of preparing for investor protection, fair market value assessment, and institutional-grade asset custody and management, referencing the American market where the Bitcoin spot ETF was approved.

Currently, KODA provides custody services to over 200 wallets, and its corporate client base has reached over 50 entities. As a leading player in the digital asset custody market, KODA continues to monitor domestic and international trends related to the institutionalization of digital assets, committed to contributing to the development of a safe and trustworthy digital asset ecosystem.

![[November]Uptober No More](https://coinhubkorea.com/wp-content/uploads/2025/10/Whisk_d78880efb01a730907f4be201effefe1dr-1-100x70.jpeg)