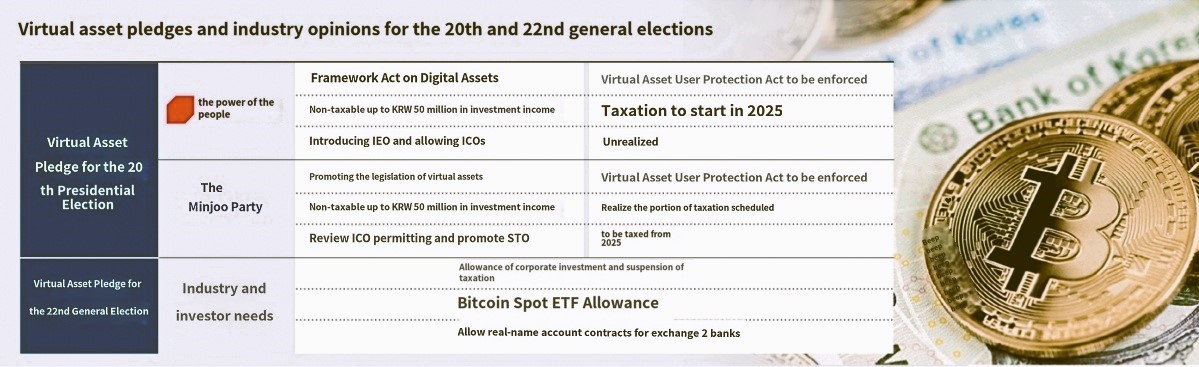

As the general election approaches, the political realm is focusing its attention on cryptocurrency-related pledges to captivate voters. Both the ruling and opposition parties are proposing various policies to revitalize the cryptocurrency market, aiming especially to capture the hearts of the 2040 age demographic. The People Power Party is planning to announce pledges that include allowing domestic investment in Bitcoin spot exchange-traded funds (ETFs), permitting corporate cryptocurrency investments, and establishing procedures for domestic cryptocurrency issuance. The Democratic Party proposes raising the cryptocurrency tax exemption limit from the current 2.5 million won to 50 million won. Additionally, the Democratic Party has announced plans to legalize the digital asset ecosystem, aiming to ensure market transparency and safe investment opportunities.

The cryptocurrency pledges come at a time when the market is riding an upward trend, fueled by the U.S. Securities and Exchange Commission’s (SEC) approval of Bitcoin spot ETFs and anticipatory surges ahead of cryptocurrency halving events, drawing attention from the 6.9 million domestic cryptocurrency users. This is part of a strategy by the political realm to leverage cryptocurrency-related pledges to win over voters amidst positive market shifts.

However, concerns have been raised about the feasibility of these pledges becoming reality and forming a national consensus. Considering the global interconnectedness and technical complexities of the cryptocurrency market, regulating it solely with domestic laws could prove challenging. There’s also a highlighted need for specific legislation to mitigate technological threats posed by advancements in blockchain technology.

Industry stakeholders view the proposal of investor-friendly bills positively, anticipating that the stabilization of regulations could lead to an influx of new investment capital. Additionally, there’s optimism that the ambiguity surrounding corporate investments in cryptocurrencies will be resolved, moving away from the current state of shadow regulation.

The political arena’s announcement of cryptocurrency-related pledges serves to heighten interest in cryptocurrencies as a new asset class among voters, presenting the future potential for market development. However, it remains crucial to closely examine whether these pledges can adequately address the complex issues of the cryptocurrency market and protect the real interests of the populace.