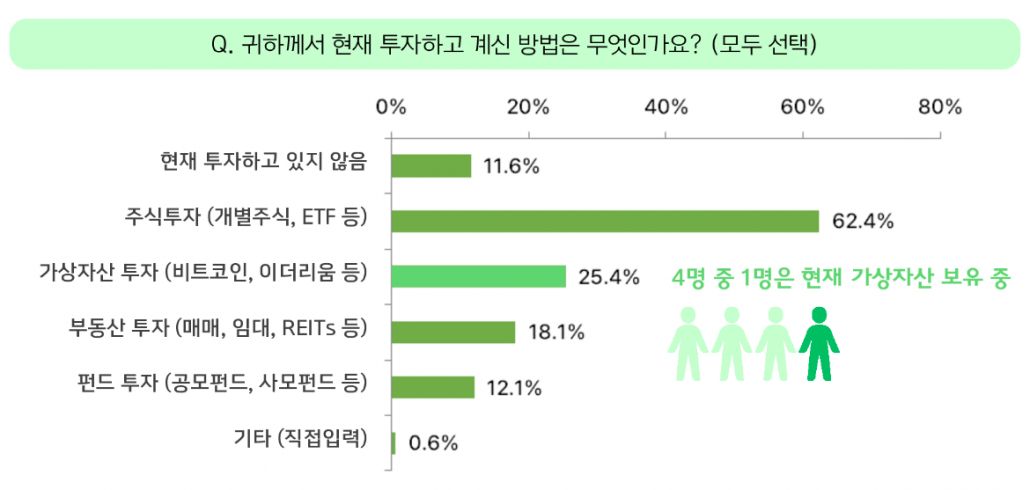

A recent survey revealed that 25% of Korean adults own cryptocurrency, surpassing the 19% ownership rate in the U.S. Conducted by Hashed Open Research, the study found that Bitcoin (BTC) and Ethereum (ETH) are the most commonly held assets among Korean investors.

Why Is Crypto Ownership Higher in Korea?

- High Digital Finance Adoption

Korea’s well-developed fintech and mobile banking infrastructure makes it easier for investors to access digital assets. - Alternative Investment Amid Market Volatility

As stock and real estate markets face fluctuations, cryptocurrencies have emerged as an alternative investment option. - User-Friendly Crypto Exchanges

Platforms like Upbit and Bithumb offer seamless access to crypto trading with KRW support, attracting more investors.

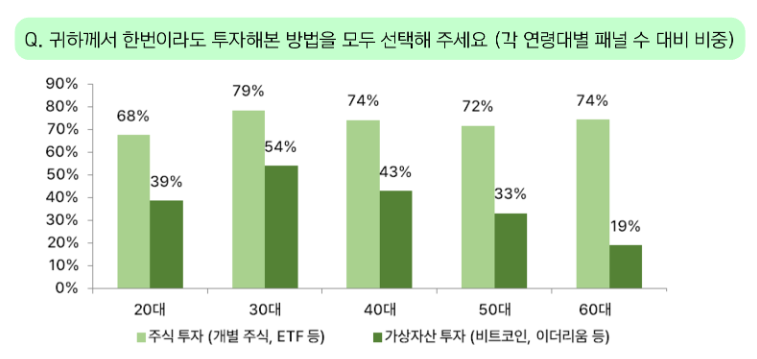

MZ Generation Leads, Older Investors Follow

Millennials and Gen Z (MZ generation) dominate crypto ownership in Korea, drawn by the potential for quick returns. Meanwhile, interest among investors in their 40s and older is also rising, particularly among those with prior experience in stock trading.

Future Outlook

Experts predict that Korea’s crypto market will continue to grow, backed by regulatory improvements and increasing institutional interest. With positive global developments, such as Bitcoin ETF approvals, investor confidence remains strong. However, given the high market volatility, analysts urge caution when investing in crypto assets.